1

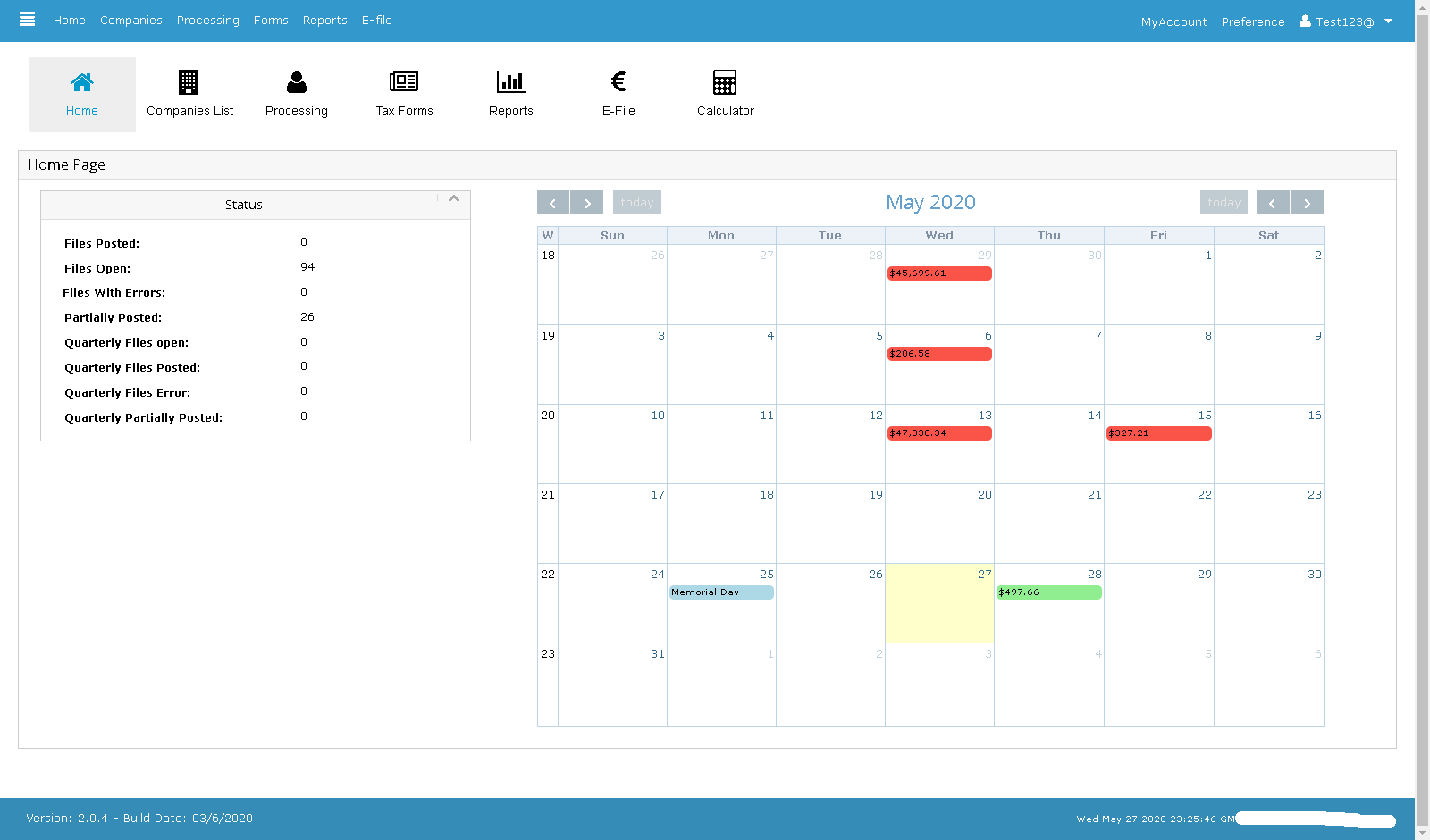

As you see here, our payroll compliance system lets you view in a calendar when you will process, schedule, file tax payments in the company dashboard. Customer daily payroll files and quarterly files are processed accordingly. Our application is totally built-in cloud using the latest software tools for maximum performance and usability.

2

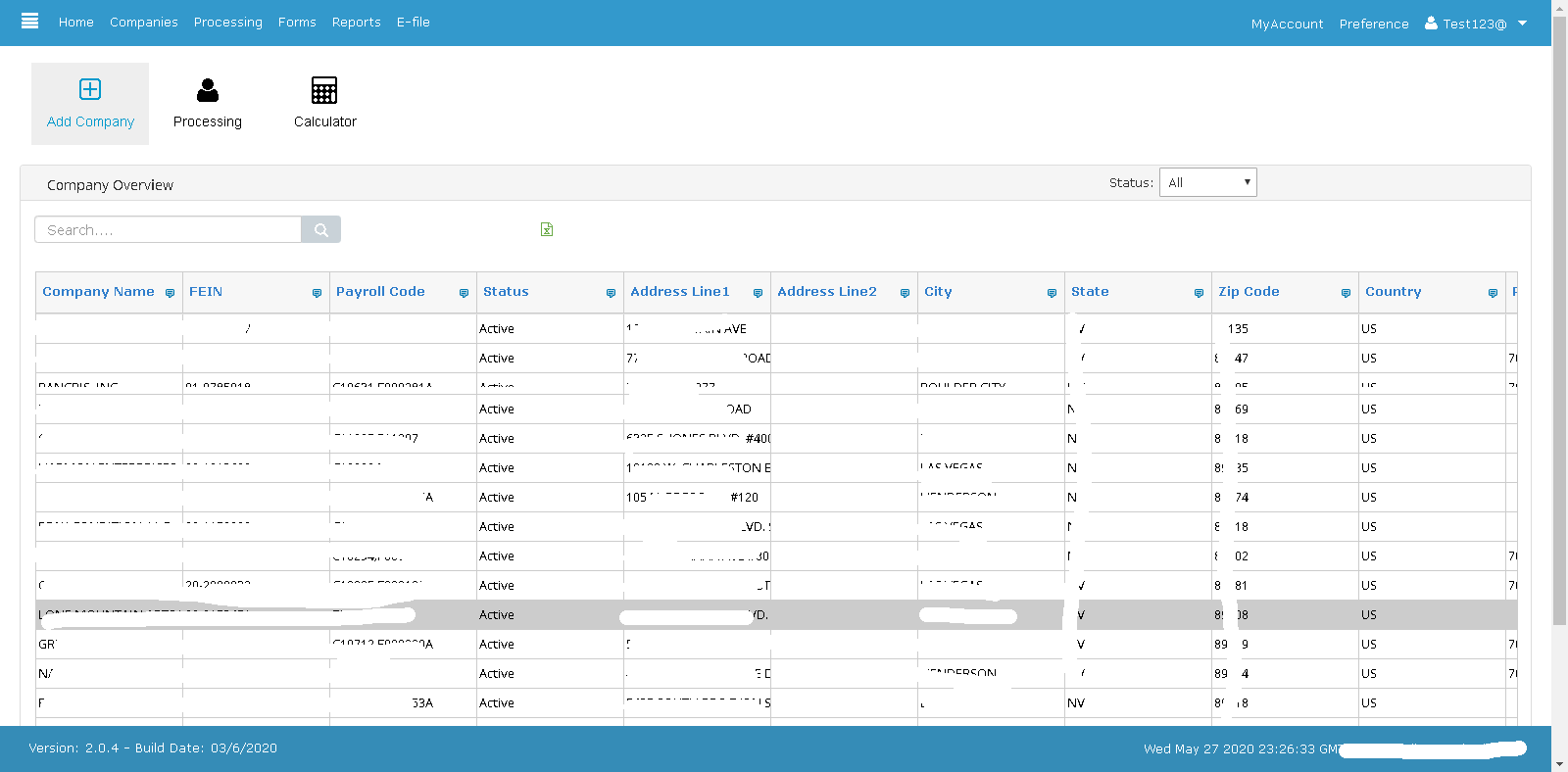

This shows a list of companies whose tax filings can be managed by our customers. The end customer can be any company who can be a PEO, ASO, or Payroll Service Bureau. Customers can work with any of their clients as shown on this screen to process payroll tax payments and filings.

3

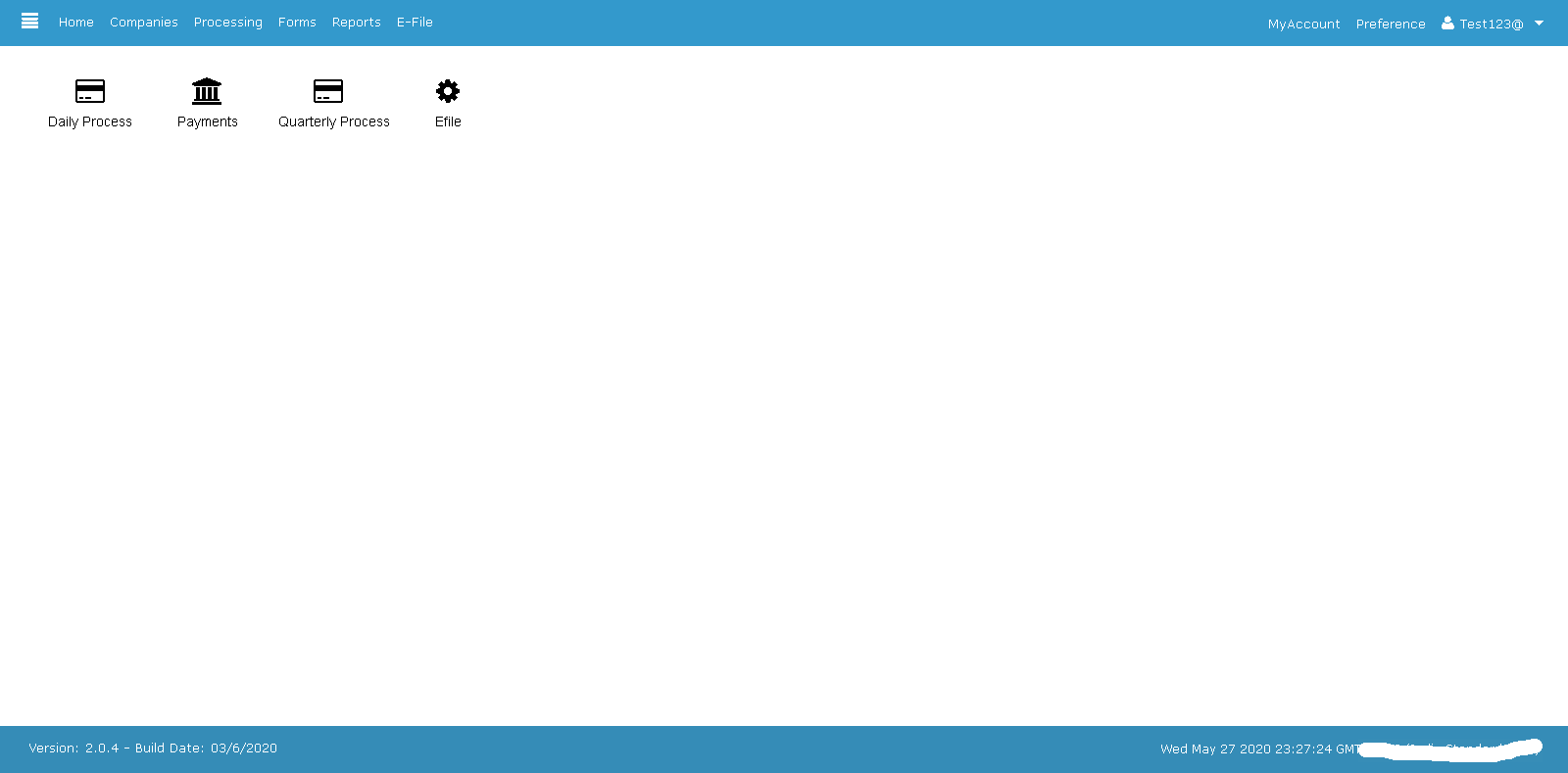

As you see here, we process payments and tax filings by reviewing and processing daily and quarterly payroll files. Our system is able to process payroll taxes via the eFile system we have developed as part of our world-class solution.

As a client of ours, you may be managing payroll tax filings and payments for many (hundreds) clients who are uniquely defined by their FEINs (Fed. TaxIDs). We make the workflow of these processes so easy to use to make you very productive with the help of many time-saving features and tools in our payroll tax compliance software cloud-based solution.

4

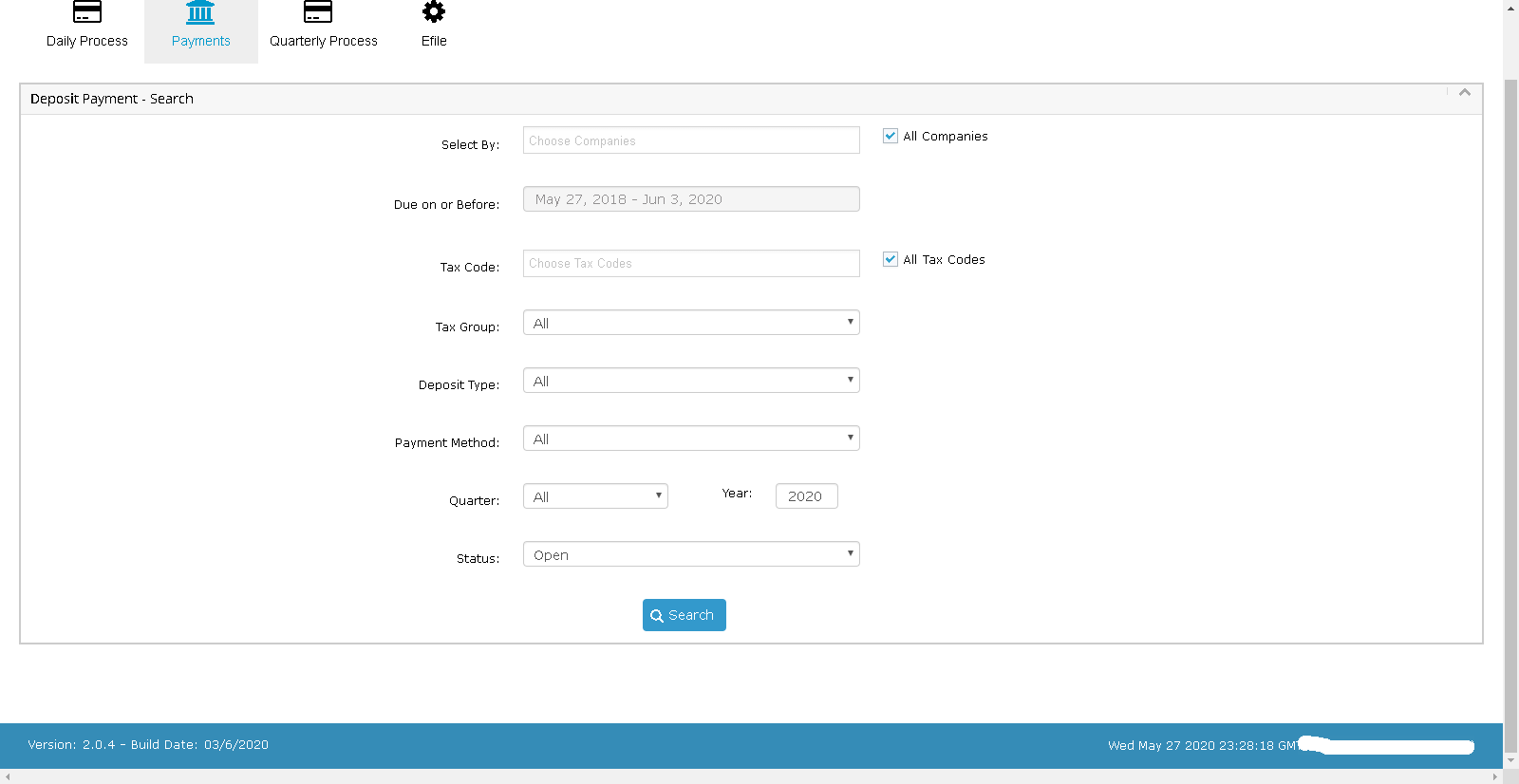

Our smart database payment search tool helps search the payroll tax deposits made by one or more clients of yours (companies) to one or more tax authorities (more than 10,000 of them). The system also can find these payment details whether you have paid by EFT or check or ACH or Wire Transfer.

The system is capable of searching payments across multiple quarters of tax filings or in one just one-quarter of payroll tax deposits. In other words, we have a very comprehensive and deeply analytical payroll deposits analysis capability in our enterprise on the cloud payroll tax compliance software system.

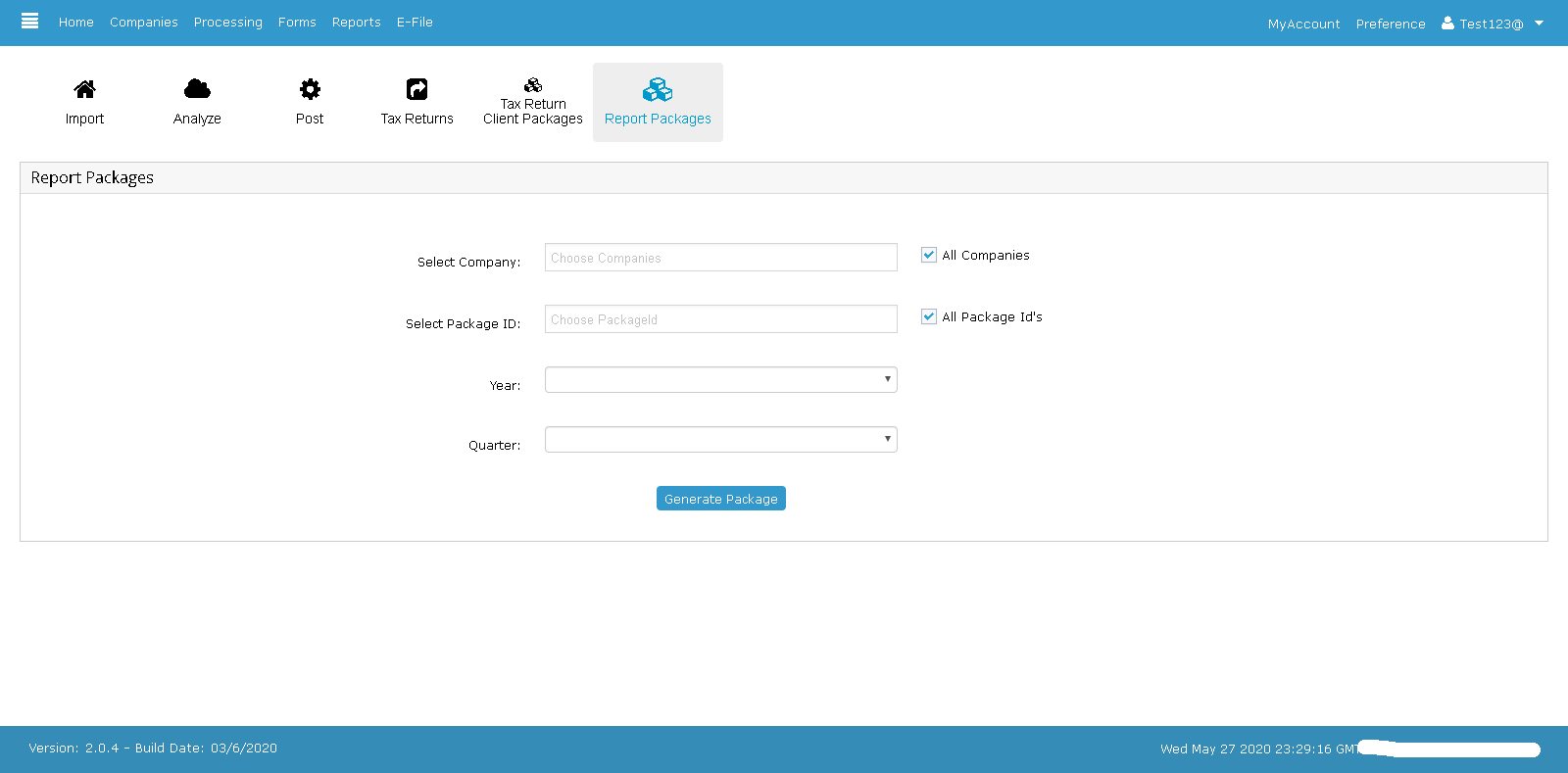

5

We have developed extensive reporting packages. These packages have many reports for payroll taxes, deposits, filings, and tax authority information. These reports act as paper-back printed documents for documentation, tax records, and payroll-related journals.

Reports can be grouped by quarter or by year or by one or many clients (companies) for record-keeping purposes. Our one coalescence package ZIP file will have all related tax documents that help for your internal company audit purposes.

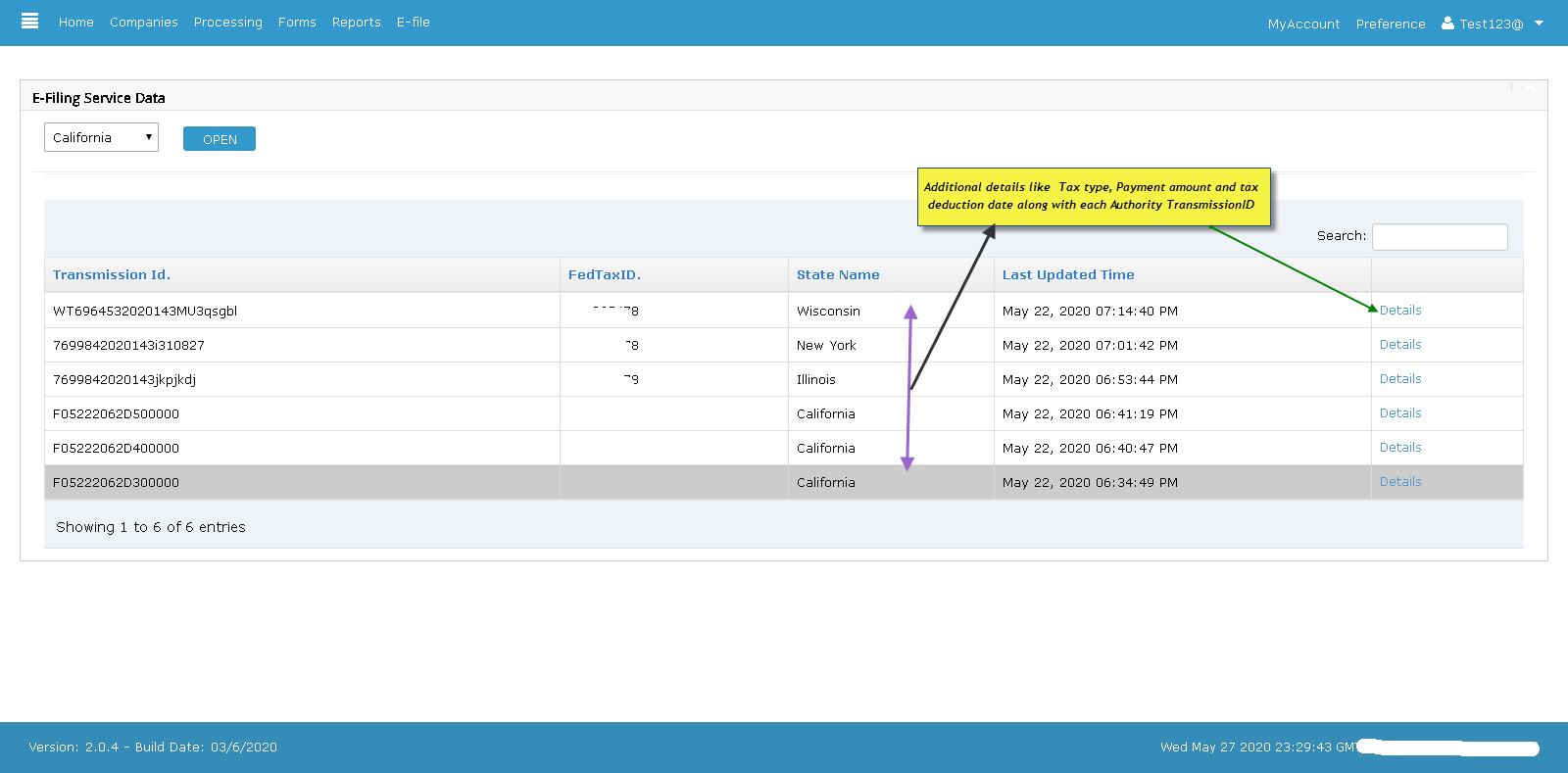

6

We have an integrated EFiling system that lets you E-File for Federal, State, and many local tax authorities. Our EFile system lets you track using the TrasmissionID. As you see on this screen, we can process eFile for many states and federal tax authorities.

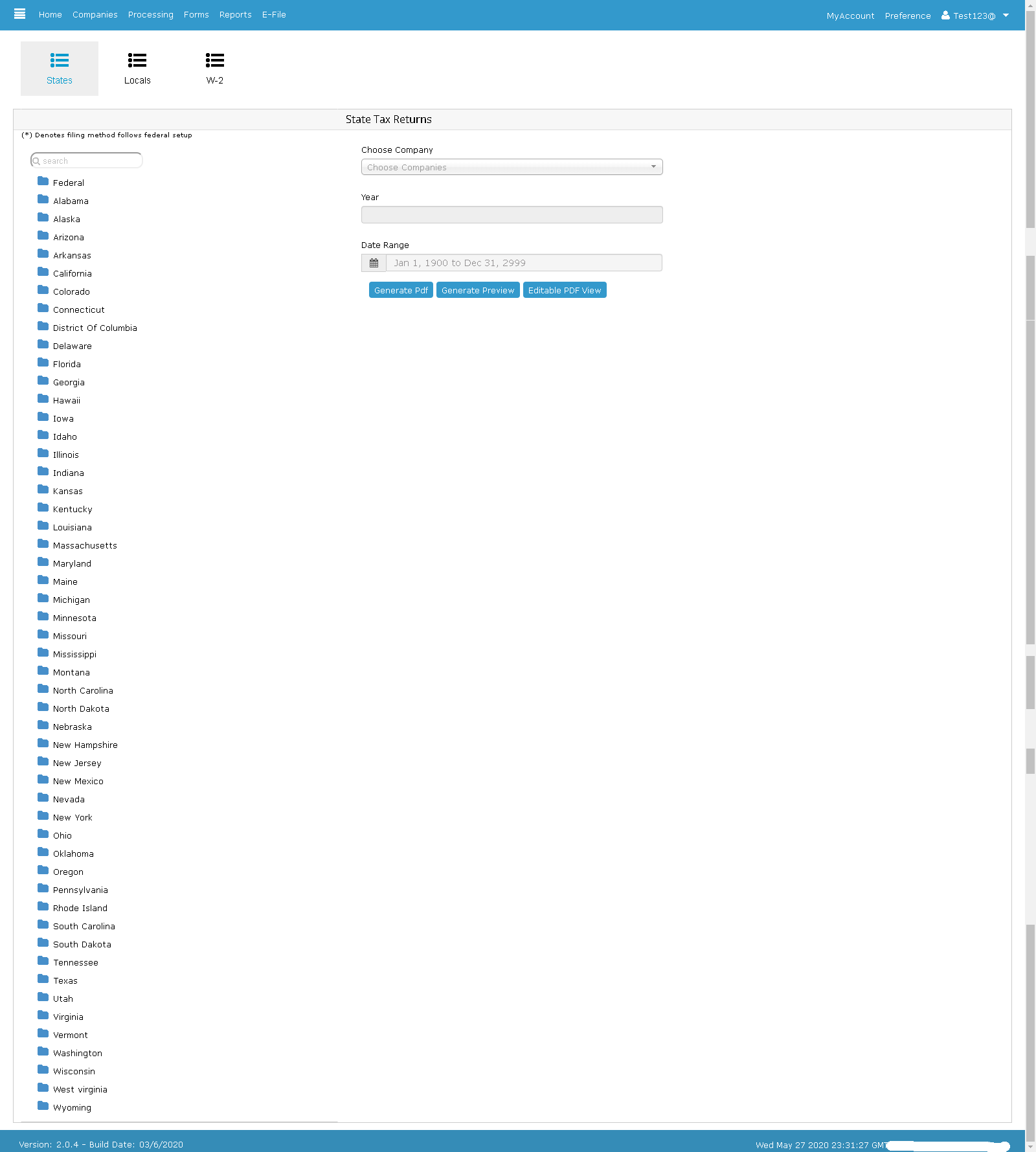

7

Federal and State tax returns may be retrieved for your review. You also may save these documents in PDF file format. In situations like Payroll Tax Forms Amendment filings, the system lets you EDIT the PDF file and save it after making manual changes, then print it and send the Amended tax returns to the tax authority. You can also keep a hard copy of your Federal and state tax forms like Federal 940, 941, State Withholding, Unemployment tax returns.