1

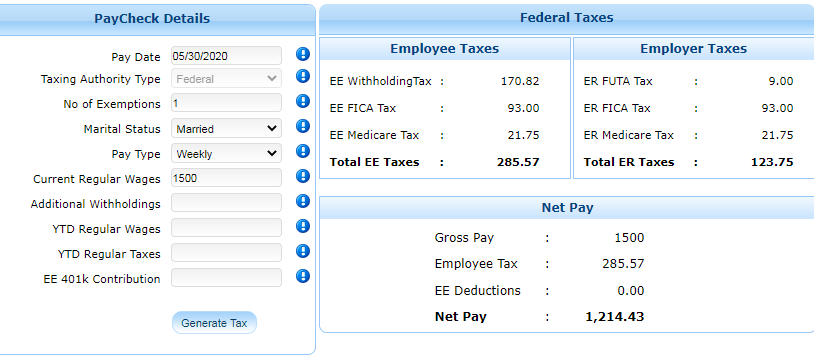

This example is for states that do not have state withholding taxes like Texas, Nevada, and others. As you see in the screenshot, the user can enter payroll details like wages, marital status, check date and other W-4 details like personal exemptions, YTD wages, the calculator API computes the net pay, all the employee and employer-related payroll taxes.

2

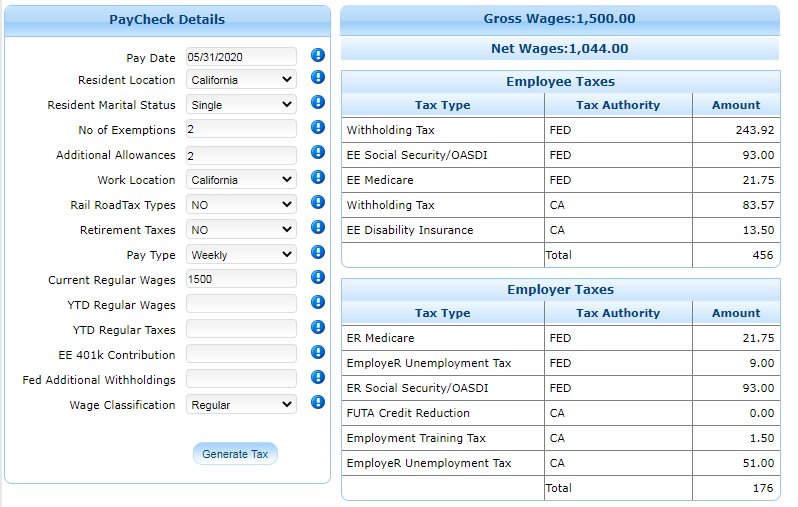

The payroll tax calculation for states that have withholding taxes. This example is for an employee living and working in the state of California.

3

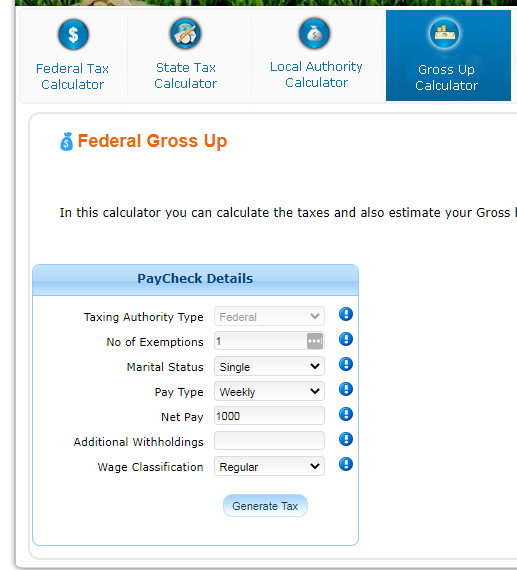

You can compute GrossUp payroll taxes by entering the employee net pay and the system reverse calculates the Gross Pay and associated payroll taxes.

4

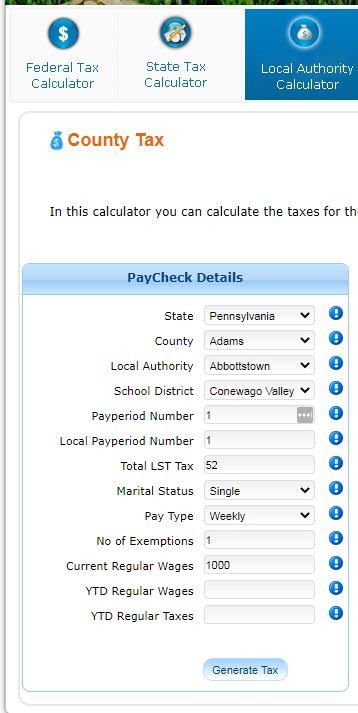

This screen is for states that have local payroll taxes like the state of Pennsylvania, Ohio, Kentucky and others. Our tax engine calculator computes all the County, Municipalities, School district payroll taxes.